Published on February 08, 2026

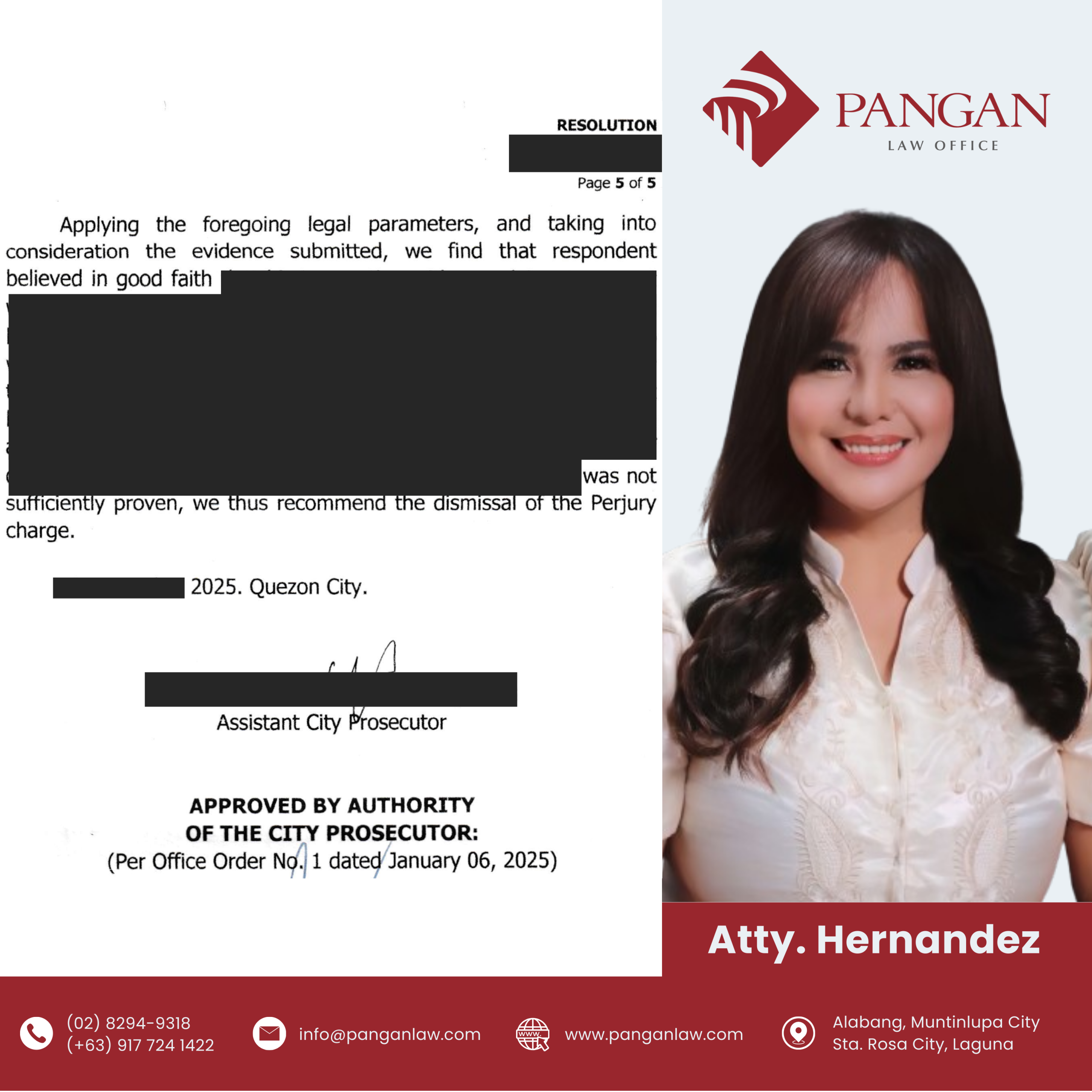

Applying the foregoing legal parameters, and taking into consideration the evidence submitted, we find that respondent believed in good faith that his transaction with complainant was not what complainant alleges it to be. Admittedly, there were talks between the parties. Unless the agreement has been reduced into writing, however, respondent believed in good faith that whatever transpired was merely suggestive, and not conclusive. Respondent likewise presented receipts of payments and believed the same to be applied for taxation purposes. Considering that the element of deliberateness and willfulness in the assertion of a falsehood was not sufficiently proven, we thus recommend the dismissal of the Perjury charge.

Disclaimer:

The contents of this website are for general information and educational purposes only and do not constitute legal advice. No attorney-client relationship is formed by using this site. We strive for accuracy, but we cannot guarantee that the information is always up-to-date or error-free.

Use of this site and its contents is at your own risk. This website and its authors disclaim any liability for any loss or damage, whether direct, indirect, incidental, consequential, or otherwise, arising from the use or misuse of the information provided on this website.

For specific legal advice, please consult our law firm: CONTACT US